Having A Difficult Time Recognizing Home Mortgages? Follow These Tips!

Content writer-Crowley HooperBuilding with the right mortgage company is very important when it comes to feeling good about your home purchase. If you choose the wrong company or wrong terms, then you're not going to be satisfied. https://www.sentinel-echo.com/news/scams-in-kentucky-and-how-to-avoid-them/article_5611ff28-a0c8-11ec-8ad4-870d6f1a6f32.html don't want to create problems for yourself, so keep reading in order to learn how to be satisfied with the mortgage company and terms you choose.

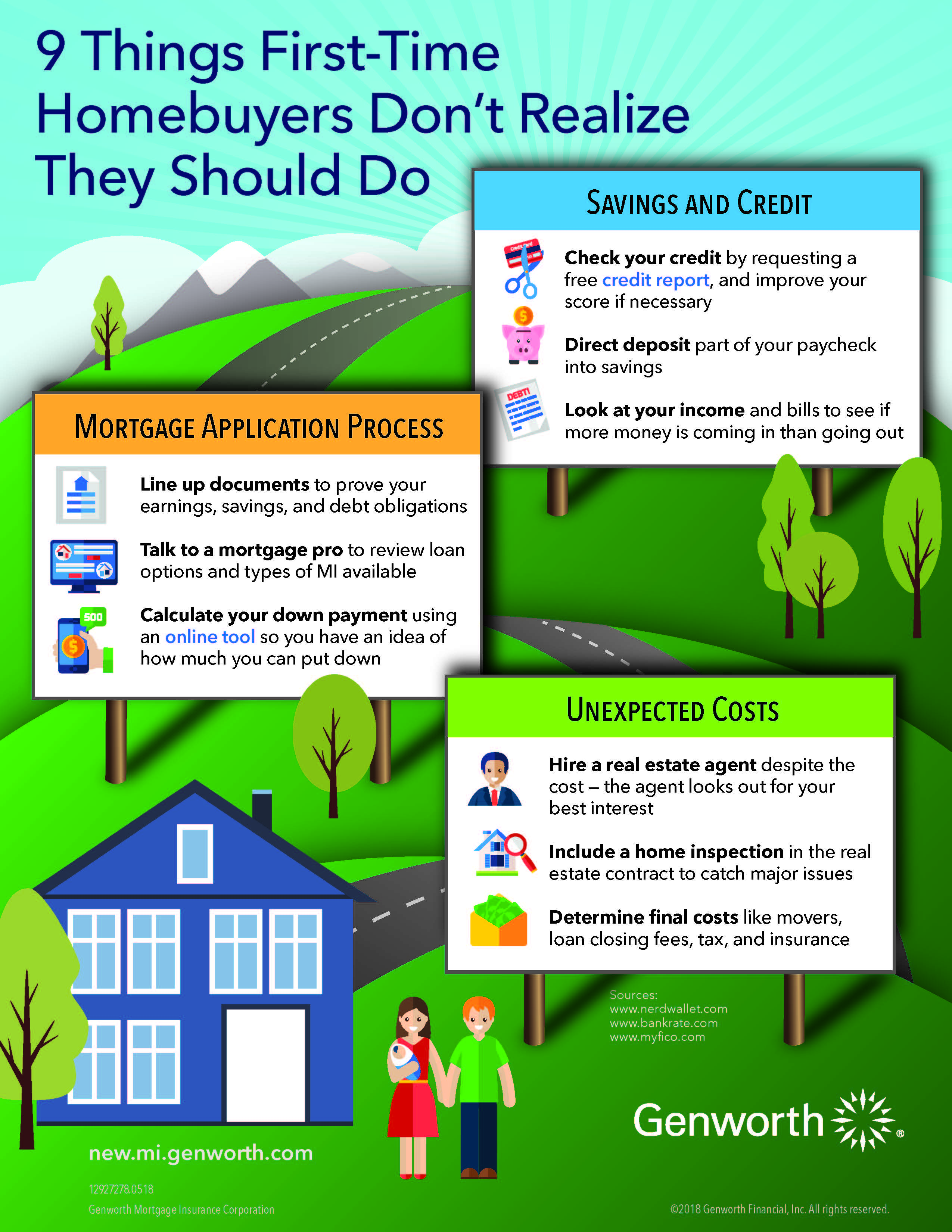

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. A good idea is for you to try to improve your credit before you apply for mortgage loan.

Avoid fudging the numbers on your loan application. It is not unusual for people to consider exaggerating their salary and other sources of income to qualify for a larger home loan. Unfortunately, this is considered froud. You can actually be criminally prosecuted, even though it doesn't seem like a big deal.

Make sure you know how much you can afford before applying for a mortgage. Do not rely on what your lender says you can afford. Make a budget, allowing room for any unexpected expenses. Use online calculators which can help you estimate how much mortgage you can afford to pay monthly.

Draw up a budget before applying for a home loan. It is important that you know how much you can realistically spend on a mortgage payment. If you aren't paying attention to your finances, it is easy to over-estimate how much you can afford to spend. Write down your income and expenses before applying for the mortgage.

Look into no closing cost options. If closing costs are concerning you, there are many offers out there where those costs are taken care of by the lender. The lender then charges you slightly more in your interest rate to make up for the difference. This can help you if immediate cash is an issue.

After https://www.bloomberg.com/news/articles/2021-10-07/advent-centerbridge-said-to-explore-takeover-of-aareal-bank 've been approved for your home mortgage and are ready to move in, consider starting a home emergency fund right away. Being a homeowner means always being prepared for the unexpected, so having a stash of cash stored away is a very smart move. You don't want to have to choose between paying your mortgage and fixing a hole in the roof down the road.

Save up for the costs of closing. Though you should already be saving for your down payment, you should also save to pay the closing costs. They are the costs associated with the paperwork transactions, and the actual transfer of the home to you. If you do not save, you may find yourself faced with thousands of dollars due.

Don't apply for new credit and don't cancel existing credit cards in the six months before applying for a mortgage loan. Mortgage brokers are looking for consistency. Any time you apply for credit, it goes on your credit report. Avoid charging a large amount during that time and make every payment on time.

Let your social circle know that you are trying to get a mortgage. Friends, family and even coworkers can be wonderful sources of referrals and first hand testimony as to who to use or avoid. Get online and seek out reviews and feedback from previous customers to get a feel for who is right for you.

Understand what happens if you stop paying your home mortgage. It's important to get what the ramifications are so that you really know the seriousness of such a big loan as a home mortgage. Not paying can lead to a lower credit score and potentially losing your home! It's a big deal.

Rebuild or repair your credit before shopping for a home mortgage. A good credit history and credit score qualifies you for a better interest rate. It is also frustrating to find the perfect house but not qualify for the loan you need. Taking the time to fix your credit before buying a house will save you money in the long run.

Avoid questionable lenders. While most are legitimate, some will try to take homeowners for a ride, stealing their money and acting unethically. Steer clear of slick lenders who try to persuade you. Don't sign things if you think the rates are just too high. Understand how your credit rating will affect your mortgage loan. Lenders who encourage you to lie about even small things on your application are bad news.

The easiest mortgage to obtain is the balloon mortgage. This is a short-term loan option, and whatever you owe on your mortgage will be refinanced once your loan's term expires. A balloon loan is risky since rates can increase by the time you need to refinance the balance you still owe.

If you can, you should avoid a home mortgage that includes a prepayment penalty clause. You may find an opportunity to refinance at a lower rate in the future, and you do not want to be held back by penalties. Be sure to keep this tip in mind as you search for the best home mortgage available.

Never sign a loan when you are unsure of certain pieces of language in the terms sheet. Get the answers you need asap. If the lender is using unclear or confusing language, it could be a sign that it is hiding terms that they'd rather you not know. Be 100% secure in what you are signing.

Get the best rate with the lender you have now by being aware of rates offered by others. There are a lot of financial institutions, both online and in the real world, that offer very good interest rates. You can use this information to motivate your financial planner to come up with more attractive offers.

There are a lot of fees associated with the process of purchasing a home and you should have them put to the side prior to applying. If a lender sees that you have enough money set aside to pay for all of your closing costs, they may be more likely to approve your loan.

Before you buy a home, you need a home mortgage. You have to have a bit of education before you start the process of applying, though. Use this information to get the loan you want.